Nvidia Stock l American companies are exceeding Q4 earnings estimates but are adopting a cautious stance for the future. This has led to a decline in the market. Analysts are lowering their earnings estimates for Q1 and Q2. This is not due to weak earnings from companies, but rather a reduction in future expectations. This is affecting investor sentiment and market trends.

On Wednesday, there was a surge in the US stock markets. Inflation figures were lower than expected, which halted a significant decline in the markets. However, US President Donald Trump’s trade war prevented this gain from advancing much further. Both the S&P 500 and Nasdaq closed with gains, particularly benefiting from tech and tech-related stocks.

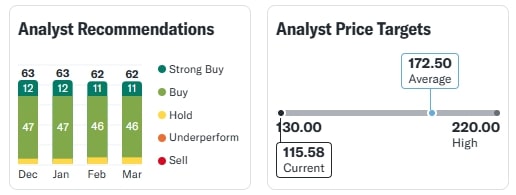

However, Nvidia’s stock is now around $115.58 per equity share. The AI stock’s 52-week low is $75.61 and the 52-week high is $153.13.

Wall Street Analyst sees Nvidia (NASDAQ: NVDA) buying opportunity

Wells Fargo analyst Aaron Rakers regards Nvidia’s stock price decline as buying opportunity. Aaron Rakers has assigned an overweight rating and a price target (NASDAQ: NVDA) $185 to the chipmaker.

According to Investors Business Daily report, Melius Research analyst Ben Reitzes reiterated a buy rating on Nvidia stock (NASDAQ: NVDA) but reduced his two-year price target from $195 to $170.

About Nvidia

According to Nasdaq, Nvidia is the top designer of discrete graphics processing units that enhance user experience on computing platforms. The company’s chips are used in a variety of markets, including high-end PCs for gaming, data centres, and automotive infotainment systems.